Engagement Ring Buying Guide

Not sure how to buy an engagement ring? You're not alone, and you're in the right hands! Our diamond experts have put together this comprehensive engagement ring buying guide to help you get the moment right.

In this buying guide, we'll cover:

- Setting a Budget

- Engagement Ring Styles and Settings

- How to Choose a High-Quality Diamond

- How to Choose a Ring Your Partner Will Love

- Where to Buy an Engagement Ring

Let's get started!

Chapter 1: Setting a Budget

The first thing you need to ask yourself when you’re prepared to buy an engagement ring is not about the shape of the diamond or the setting of the ring – it’s about money. How much money do you want to spend on an engagement ring?

The idea of setting a budget is such an essential first step in buying an engagement ring because if you go into the process without any concept of the cost of things, you’re going to be in for a bad time. You’ll start building out a perfect ring, find precisely the elements you want, and then when you get to checkout it may end up costing way more than you can afford, forcing you to go back and chip away at the dream ring you designed. No one wants to do that.

This is why Chapter 1 of our Engagement Ring Buying Guide starts with setting a budget. Once you have that budget in mind, you’ll realize that you are still able to build a dream ring within your financial boundaries, and when you get to checkout, you’ll be over the moon with joy. That’s how the buying experience should be.

The Myths of Engagement Ring Budgets

Before we get into the best ways to go about setting a budget for your rings, let’s talk about some common myths and misconceptions people have about how much an engagement ring should cost. The most common is the three-month salary myth.

Most people at some point in their lives have heard some variation of this myth. If you’re buying an engagement ring, expect to spend 3 months’ salary or 25% of your annual gross salary. While this rule might be suitable for some people, it is absolutely not a catch-all that should determine everybody’s budget.

Let’s put some context around that. If you make $50,000 a year, should you really spend $12,500 on an engagement ring? We are not financial advisors, but that might be quite a chunk of change for a 25-year-old who is paying $1,800 in monthly rent and has $40,000 in student loan debt still to their name. However, what about a 35-year-old making $100,000, with no debt, with considerable amounts of investments and wealth to their name – is $25,000 the right amount for them? Maybe.

That’s why the three-month rule is a myth. Fiction. A lie. In fact, if this example shows us anything it’s that people getting married are often in very different places in their lives, so one all-encompassing rule to determine how to set your budget simply doesn’t make sense.

Setting Your Priorities

So, the three-month rule is a myth, and it’s good we cleared that up, but we still don’t have an answer. How do we set a budget? We start by deciding what our priorities are – in life and in an engagement ring.

The first thing you should do when setting your priorities is to ask yourself, “What does my partner want, and what do they expect?” Who are you giving this ring to?

Does the person you’re giving this ring to have a dream engagement ring? Do they expect a diamond that is at least one carat? Would they rather save money for the future together than spend more on a ring?

Answering some of these questions will really let you understand what your partner’s priorities are, and then you can see if they match your priorities. If they do – great! If not? Maybe sit down and have a conversation about it. An engagement ring is a big purchase, and you don’t want to miss the mark because your priorities aren’t aligned.

Remember – setting a budget is a very personal experience, and your priorities aren’t going to be the same as your best friend from middle school or your cousin from Boston. It’s perfectly fine for your budget to be twice as much or half as much as someone else's, as long as your budget aligns with your life priorities.

Now, what are your priorities in a ring? Is it size? Shape? Setting? Some elements of an engagement ring will produce a bigger variation in cost than others.

If the most important thing to you is getting a pear-shaped diamond, then you don’t necessarily need to worry about stretching your budget because there are expensive pear-shaped rings and cheap pear-shaped rings. If the most important part is carat weight, that’s a different story. If you know you don’t want to settle for anything under 1.5 carats, you need to go into the budget-setting process understanding that there’s a ceiling to what you will spend. For example, the current least expensive 1.5-carat earth diamond in Ritani’s inventory is an Asscher cut which costs just over $2,300.

Assessing Your Financial Situation

So, you’ve assessed what’s important to you – in life and in a ring – which means you are starting to get an idea of what you want, but before you go into any detail in your search for the perfect engagement ring, you need to finish setting your budget. This is the part of the buying guide where you must be honest with yourself and determine how much money you have.

Not in your pocket or bank account right this second but look at your life and see where you are financially. This is where you start: How much money do you take home each month? Let’s write that number down and put a pin in it.

How much money do you spend each month on fixed costs? These are things like rent or mortgage payments, utility bills, car payments, transportation, daycare, etc. – things you know you will pay each month and know (generally speaking) how much you will owe.

Now, ask yourself how much debt you’re carrying. Credit card debt? Student loan debt? (Mortgage debt should go into your fixed cost calculation since you’re building equity with those payments). How much do you owe monthly for those bills, and how long will it take you to pay them off?

Finally, take the number you’re taking home each month, then subtract your monthly expenses and monthly debt payments. After getting rid of all your fixed costs, how much money do you have left over each month? This is your maximum excess income.

Take Home Income – (Fixed Expenses + Debt Payments) = Maximum Excess Monthly Income

Excess income doesn’t necessarily mean money you can do whatever you want with, which is why we’re calling it the Maximum Excess Monthly Income at this point. You’ll still need to buy groceries, and you may still want to go out to dinner or see a movie. These things will cost you, but you can budget these items. Spend a bit less on Friday night drinks so you can save more for your ring. When you’re considering your excess income for the purposes of budgeting, you need to ask yourself how much of that Maximum Excess Monthly Income you are willing to save on a monthly basis and not spend on something extra you might want – it won’t be all of it unless you’re in a situation where you don’t need to buy food. This number is your Excess Monthly Income.

Now that you have an idea of the excess income you can put toward a significant expense, let’s go back to that bank account – do you have any money saved? Do you have money that you’ve put away specifically for this purpose? Great!

So, How Do You Set Your Budget?

Now that you’ve listed your priorities and sorted your finances, you are ready to determine your number and set your budget.

Here’s an example: Say you have $4,000 already saved that you’re comfortable putting toward a ring. You want to propose in the next six months but want to have the ring in hand in three months’ time. You have $600 of Excess Monthly Income you would be able to put toward saving more during this time. That makes your budget $4,000 to ($4,000 + (3 x $600)), or $4,000 to $5,800.

Can You Finance A Ring?

Financing is not for everybody, but you can absolutely finance a ring with Ritani, which will allow you to split the cost of the ring over an extended period of time. This also takes the burden off of saving upfront if you’re ready to propose now and want your engagement ring ASAP.

That being said, you must be careful with your financing to make sure you don’t build up more debt than you can handle. So how do you know how much you would be able to finance? It’s the same formula, except instead of adding in how long you’re willing to wait, you consider how long you’re willing to make payments on a monthly basis. These are payments that will become fixed costs in your life, so make sure you are comfortable with the amount you choose.

Amount Saved + (Months to Finance * Excess Monthly Income) = Financing Budget

Let’s say you have nothing saved but are able to put $800 per month in Excess Monthly Income toward the purchase of your engagement ring. With Ritani, you get interest-free financing if you pay in full within 12 months, so this is the maximum amount of time you’re willing to finance the cost. Your budget starts to come together like this:

$0 + (12 * $800) = $9,600

$9,600 becomes the maximum of your budget, and as long as you find a ring under that cost, you will be able to pay down the purchase in exactly as much time as you have allotted. LEARN MORE>>>

Conclusion

Buying an engagement ring can be a daunting process, which is why setting a budget is so important. Once you have a budget you are comfortable with based on what’s important to you and how much money you are willing to put toward a ring, a weight gets lifted off your shoulders, and the rest of the hunt becomes so much more fun. The money part is out of the way, and now it’s just about finding the perfect ring for the person you love. LEARN MORE>>>

If you have questions about setting your budget or financing a ring, don’t hesitate to reach out to our top-notch customer service team. They can walk you through the process and ensure you have all of the information you need.

Chapter 2: Styles, Settings, and Shapes

In Chapter 1 of our Engagement Ring Buying Guide, we took you through the money part of the process to make sure you know how to set a budget and stick to it. Now that we have that out of the way, we can get into the fun stuff.

When it comes to picking out an engagement ring for the person you love, there are two primary components you need to decide on: the center stone, and the setting. In Chapter 3 we will cover in great detail the 4 Cs of a diamond and how to make sure you’re picking the right stone for your ring, but Chapter 2 is all about the setting.

The ring portion of the engagement ring in and of itself has several subcategories which we will take you through one by one so that you understand each element of what you’re looking for and buying into. This includes the ring style, the metal, and of course the actual setting in which the diamond rests on the ring.

A quick note before we begin: the word “setting” can be a broad term or a specific term depending on the context. It’s common to refer to the whole ring portion of the engagement ring (everything besides the diamond) as the setting. Going forward in this article, for the sake of clarity, we will refer to the whole ring portion as the ring, and when we say setting, we’re talking about the little piece that holds the diamond. Hopefully, this helps.

Engagement Ring Styles

Our introduction to engagement ring styles comes with a disclaimer: an engagement ring can be whatever you want it to be. If you truly wanted to, you could twist the wrapper of a Snickers bar into a ring and ask your significant other to marry you. That might be your style and if it is, more power to you! Here, however, we are going to take you through six styles you’ll be able to find shopping online, in stores, or wherever engagement rings are sold.

Solitaire Engagement Rings

The solitaire engagement ring is simple and classic. It is made up of nothing but a metal – often gold or platinum – and a setting for the center stone. There are several reasons people might choose a solitaire style for their ring, but arguably its greatest asset is its simplicity.

A solitaire ring is not in any way distracting, which means that all eyes are focused on the diamond in the center. It is the perfect style to be both understated and make that bling pop. The metal can still be formed into a variety of designs which will make each solitaire ring unique, but the main concept of this ring is to keep the focus on that center stone.

Sidestone Engagement Rings

Sidestone engagement rings keep the classic feel of the solitaire ring but add some much smaller diamonds into the band of the ring on either side of the center stone. These extra stones make for extra sparkle and serve as the perfect complement to a gorgeous diamond.

One thing that makes sidestone rings special is that they can range from very simple to extravagant and over the top, whichever your style may entail. You can choose between a few diamonds coming off the edge or having several large diamonds wrapping nearly all the way around the ring. In the end, when picking your center stone, you want to make sure it is large enough to stand out from the side stones of the ring.

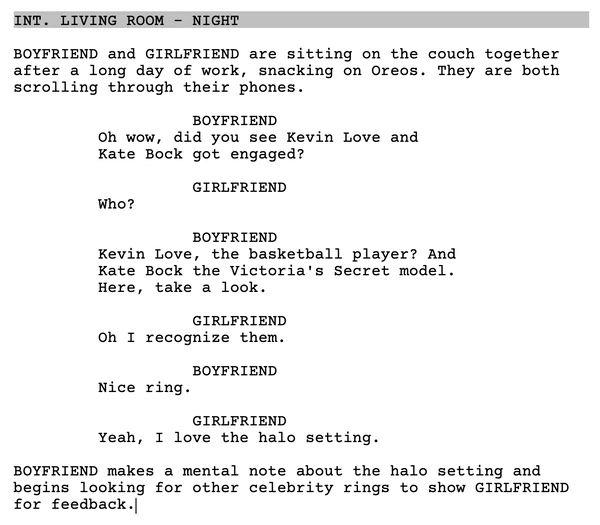

Halo Engagement Rings

The term halo engagement ring refers to a setting in which a center stone is placed into a ring of smaller stones, forming a halo. If you’re looking for maximum sparkle, the halo might be the perfect ring to fit your needs. The halo of diamonds forms an effect that makes the center stone look bigger and will catch more light than a solitaire setting, which is what creates the sparkling effect of your ring.

Many people assume that the halo style can only be paired with a round diamond, but that is not true. Halo rings can be designed to fit a variety of shapes, oftentimes making for a very unique ring. Halo engagement rings can also have a plain band; side stones set in the band are not required.

Three-Stone Engagement Rings

If a sidestone ring is a ring with stones on the side and a halo ring is a ring with a halo around the center stone, what do you think a three-stone ring is? You guessed correctly – it’s a ring with three stones.

Obvious naming conventions aside, the three-stone ring is one of the most glamorous engagement ring styles on the market. Your center stone will always have the most carat weight, but the two stones on either side will still be larger than what you will find on most sidestone or halo rings. They provide a perfect balance to your center stone as a sidestone ring would, but without needing stones to pour all the way down the ring. This style is a great option if you are looking for a ring that has balance, but also want your metal to shine. You won’t have to take away from the side of the ring to add the extra flair.

Vintage Engagement Rings

Ritani’s vintage engagement rings are the most unique of our collection, and often present as some variation of one of the four previous styles of ring. While not necessarily a defined motif, vintage rings often present themselves by combining elements from other rings, twisting and manipulating the metal of the ring, or drawing inspiration from a past era. Elements like open halos or floral designs lend themselves to our vintage collection.

If you’re looking for something unique in your ring, vintage-inspired rings are one of the best ways to go.

Custom Engagement Rings

If none of the styles we talk about here speak to you and you have something in mind that you think would be perfect, customize it. Like we said in the beginning – anything can be an engagement ring.

In 2020, Ariana Grande received an engagement ring with an oval-cut diamond placed at an angle, sitting next to a pearl. Emily Ratajkowski also wears a customized ring that features two massive diamonds, a pear-cut, and a princess-cut, set next to each other.

If you want to design your own custom ring, our concierge team is ready to talk to you. LEARN MORE>>>

Which Metal Should I Choose?

No matter what style ring you end up going with, you’re going to have to choose a metal to make the ring with. If you remember the periodic table from eighth-grade science class, you know there are A LOT of metals you can pick from, from aluminum to zinc.

LEARN MORE>>>

For the purposes of your engagement ring, we’re only going to talk about the precious metals that we know will provide the most comfort, style, and durability to last a lifetime.

White Gold

White gold engagement rings have a polished shine that can really enhance the look of a colorless diamond. It also pairs nicely with a wide range of skin tones which makes it a very popular choice. That being said, 14kt white gold is the least expensive metal that Ritani offers for a couple of reasons. First, white gold is a bit less durable than its light-colored counterpart, platinum. Over time, its silver luster will fade and it will need replating.

Like all variations of gold, white gold typically is found in jewelry in 10 karats, 14 karats, 18 karats, and 24 karats. Unlike the carat of a diamond which refers to its weight, and represents its size, the karat of gold refers to its purity.

Gold purity in jewelry is segmented into 24 different parts. 24K gold means that all 24 out of 24 parts are gold, which makes it 100% pure gold. 18K gold means 18 out of 24 parts are gold, or it’s 75% pure. The remaining 25% is usually made up of silver, copper, nickel and zinc. 14K gold is 58.3% pure (14/24) and 10K gold is 41.6% pure (10/24).

Yellow Gold

Yellow gold typically looks best with warmer skin tones and can really complement a center stone that has a bit more color in it. Usually, stones with a lower color grade will also cost less, but with yellow gold, any color in the diamond could get lost in the shine of the metal.

Yellow gold will never need replating. At Ritani, we only offer 18K yellow gold since 24K is usually too soft for an engagement ring, and 14K is less pure.

Rose Gold

Like our yellow gold option, our rose gold engagement rings are only offered in 18K, which is made up of 75% gold and 25% copper, giving it that rosy color that is so unique.

Rose gold rings tend to be more durable and often don’t need a replating in their lifetime. Rose gold is the perfect option for a unique, quality ring.

Platinum

Platinum looks a lot like white gold, but there are many differences. First, platinum is about 30 times as rare as gold, making it much more valuable. Second, platinum is much more durable than white gold and will never need replating in its lifetime. Finally, platinum is hypoallergenic, so if you have sensitivities to some metals like nickel, you won’t run into any problems with our platinum rings. LEARN MORE>>>

How is the Diamond Set On The Ring?

The final part of the ring we’re going to talk about in this chapter is the setting; the piece where the diamond or center stone is secured to the ring. While customers often spend so much time trying to find the perfect diamond or try out many different styles, the setting is something that is often overlooked but can make or break the engagement ring.

There are two primary ways to set a diamond in a ring: prong settings and bezel settings. Within each category, there is a mixture of variations, leading to a seemingly endless number of setting options. We’ll go into detail below to make sure you pick out the perfect setting type for your ring.

Prong Settings

When a diamond is prong-set, that means that several tiny pieces of metal will rise from the base of the ring and hold the diamond securely in place. The number of prongs can vary, giving people different options for what they want; however, the most common prong set rings have four or six prongs.

The prong setting is very popular for a number of reasons. First, it is the classic engagement ring look. When you image-search engagement rings, almost all the pictures you see will be prong set rings. Additionally, prong-set rings are great at highlighting the center stone, raising it high off the band, and making it stand out. By raising the stone with prongs, you allow more light to enter the ring from different directions and create more of a sparkle as it bounces around inside the diamond.

Bezel Settings

Unlike the prong setting, the bezel setting secures the diamond to the ring from all sides, not just on select points of the stone. This means that the diamond is typically more secure than in a prong-set ring.

We love the bezel setting because it is much more modern than the prong setting. The bezel setting caters to someone with a much more active lifestyle or who uses their hands quite a bit, since it is more securely set. It can be perfect for first responders or someone who works often with tools.

Diamond Shapes

Diamond shapes are also sometimes called diamond cuts. The diamond cut can also refer to the cut quality of the diamond (we'll discuss this in more detail later). The diamond shape of your engagement ring is incredibly important; it sets the tone and personality of the ring. Does your partner prefer something classic and timeless, or bold and eye-catching? These are things you will have to consider when you choose the diamond shape for your engagement ring. Here are the most popular diamond shapes used in engagement rings.

Round-Cut Diamonds

You can't go wrong with a round-cut diamond! Round-cut diamonds are the #1 best-selling diamond shape. They are the most sparkly cut while also being the most expensive. A benefit of round-cut diamonds is their versatility; they will look amazing in any setting, and they are timeless. If your partner favors the traditional and/or loves beauty in simplicity, a round-cut diamond is a great choice.

Cushion-cut Diamonds

The cushion cut is another romantic and timeless diamond cut. Its silhouette is easily recognizable by its squared shape and soft, rounded corners. The cushion cut is derived from antique diamond cuts and provides gorgeous sparkle. If your partner loves classic styles with a twist, choose the cushion cut.

Princess-cut Diamonds

The princess cut is sleek, square, and bursts with sparkle. If your partner loves all things chic and modern, choose a princess-cut diamond.

Oval-cut Diamonds

The oval-cut diamond has surged in popularity in recent years. Similar to the round-cut but with an oblong shape, the oval cut beautifully blends both classic and unique aesthetics. The oval cut also provides a flattering effect on the hand by creating the illusion of a longer, slimmer finger.

Conclusion

The setting part of the engagement ring never gets the love, but it is so important to get right because if it doesn’t match your style, even the perfect diamond can’t save the ring. Remember, when you’re searching for the right setting, you have so many options, but you don’t have to feel overwhelmed. Break it down into segments – first think about the style, diamond shape, metal, and finally how you want to set the diamond.

When you finally know what you want your ring to look like, it’s time to find the diamond that will pull it all together. Chapter 3 will take you through the 4 Cs of diamonds and help you understand exactly what to look for in a stone to make the perfect engagement ring.

If you have any questions at all about engagement ring settings, ask our customer concierge team. They specialize in engagement rings and know exactly how to help you find the style that is perfect for you.

Chapter 3: How to Choose a High Quality Diamond

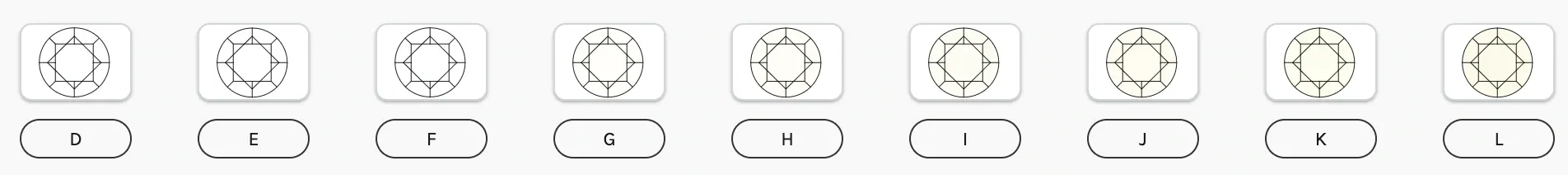

In this chapter, we will discuss the 4 Cs, which are crucial to know when shopping for a diamond. The diamond is the most important part of your engagement ring, and is typically the most expensive part of it, too. The 4 Cs are Cut, Clarity, Color, and Carat.

This grading system is used to determine a diamond’s quality, beauty, and value. Understanding the 4 Cs can help you get the best deal on your diamond and will also help you get an idea of exactly what you are paying for. Since your diamond will be the focal point of your engagement ring, you’ll want to choose the perfect one.

Let’s break down exactly what each of the 4 Cs means.

Cut

Cut is considered the most important of the 4 Cs. It can also sometimes refer to the diamond’s shape (for example, round-cut, oval-cut, etc.), but when it comes to the 4 Cs, it refers to the actual quality of the stone’s cut.

The four grades of diamond cut are Ideal, Very Good, Good, and Poor. The GIA only assigns cut grades to round-cut diamonds, so our gemologists determine a cut grade for each of our fancy-shaped diamonds. (Fancy-shaped diamonds are any diamonds that are not round.) The best cut grade a fancy-shaped diamond at Ritani can have is Very Good.

Here is what each cut grade means:

Ideal Cut

This is the cut grade we recommend for your engagement ring. An Ideal cut diamond will reflect practically all the light that enters it through the top and upper section, thus producing lots of sparkle. Ideal cut diamonds typically have excellent polish, meaning there are no visible polish lines, and excellent symmetry, meaning there are no symmetry flaws that are visible under 10x magnification. Both polish and symmetry grades (more on this in a minute) can vary for each cut grade – for example, an Ideal cut diamond won’t always be assigned an excellent symmetry grade, so it’s important to check your diamond grading report for further clarification.

Very Good Cut

A Very Good cut diamond will do a great job of reflecting most of the light that enters the diamond, creating lots of sparkle. Very Good cut diamonds typically have great polish and symmetry grades, meaning few polish lines, if any, are visible under 10x magnification, and few symmetry flaws, if any, are visible under 10x magnification.

Good Cut

Diamonds with a Good cut reflect a sufficient amount of the light that enters the diamond and will create an adequate level of sparkle. Diamonds with a Good cut typically have great or satisfactory polish and symmetry grades, meaning few polish lines, if any, will be visible under 10x magnification. Some symmetrical errors may be visible under 10x magnification.

Poor Cut

Poor cut diamonds will not sparkle very much. Unsatisfactory polish and symmetry.

Ritani does not carry poor diamonds.

You should always choose the best cut grade possible for your engagement ring. A diamond’s cut grade will dictate how much it will sparkle, and a dull diamond is not only less attractive but will also be very noticeable in an engagement ring. Since cut is so important for the appearance of your diamond, we don’t recommend purchasing a larger (higher carat) stone if that means sacrificing cut quality.

A diamond's proportions and symmetry are factors that go into its cut grade. Symmetry refers to how well the diamond’s facets are aligned. When facets are not well aligned, this will reduce the stone’s sparkle. Your diamond will also receive a symmetry grade in its grading report. Diamonds can receive the following symmetry grades: Excellent, Very Good, Good, Fair, or Poor. Ritani does not carry diamonds with a Poor symmetry grade.

| Excellent Symmetry | Cut and symmetry grades are also extremely important for complex shapes such as the marquise-cut, princess-cut, heart-cut, and pear-cut. An asymmetrical diamond will not only be less attractive, but less sparkly.  This pear-cut diamond has a Good cut, but you can see that it is not completely symmetrical. Polish is another factor that influences a diamond’s cut grade. Each diamond receives an individual polish grade along with a symmetry grade and cut grade. Polish refers to how smooth the stone’s finish is. A poor polish job can affect the diamond’s sparkle. Diamonds can receive the following polish grades: Excellent, Very Good, Good, Fair, and Poor.

Design Your Dream Engagement Ring Browse thousands of diamonds and over 100 settings. |